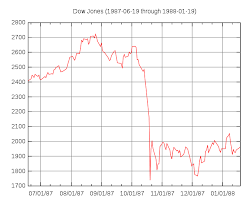

In 1987, the Dow Jones Industrial Average (Dow) reached a significant milestone, reaching a record high of 2772.4. This achievement was a reflection of the strong performance of the U.S. stock market during that year. However, this record high was just a prelude to one of the most infamous events in financial history - the stock market crash of 1987, also known as "Black Monday."

The Dow reaching 2772.4 in 1987 was a testament to the overall strength and resilience of the U.S. economy at the time. The stock market had been steadily climbing throughout the decade, fueled by factors such as economic growth, corporate profits, and investor optimism. The record high was seen as a sign of the prosperity and confidence that characterized the late 1980s.

However, on October 19, 1987, the stock market experienced a sudden and dramatic downturn. On this fateful day, the Dow Jones Industrial Average plunged by a staggering 22.6%, marking the largest single-day percentage drop in its history. The crash sent shockwaves throughout the financial world and had far-reaching implications for the global economy.

The causes of the 1987 stock market crash were complex and multifaceted. Some analysts attribute the crash to a combination of factors, including computerized trading strategies, overvaluation of stocks, and rising interest rates. Others point to the impact of international events, such as the weakening U.S. dollar and concerns about global economic stability.

The crash of 1987 had immediate and significant consequences. Billions of dollars were wiped out from the stock market, and investor confidence was severely shaken. The crash exposed vulnerabilities in the financial system and raised questions about the effectiveness of regulatory measures in place at the time.

Despite the severity of the crash, the U.S. economy managed to recover relatively quickly. The Federal Reserve, under the leadership of Chairman Alan Greenspan, took swift action to inject liquidity into the financial system and stabilize the markets. This proactive response helped to restore confidence and prevent a deeper and prolonged economic downturn.

In the aftermath of the crash, there were calls for reforms and increased regulation to prevent similar events from occurring in the future. The Securities and Exchange Commission (SEC) implemented measures to enhance market oversight and improve transparency. The crash also prompted a reevaluation of risk management practices and the development of new tools to mitigate market volatility.

The 1987 stock market crash serves as a reminder of the inherent risks and uncertainties of investing in the stock market. It highlighted the importance of diversification, risk management, and a long-term perspective when it comes to investing. The crash also emphasized the interconnectedness of global financial markets and the need for coordinated efforts to address systemic risks.