On September 21, 1978, the United States housing market was facing significant challenges and undergoing major transformations. This period marked a turning point in the country's housing landscape, with significant impacts on homeownership, lending practices, and government policies.

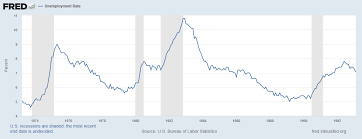

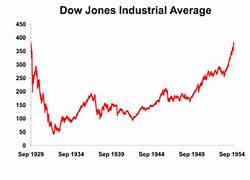

During the 1970s, the U.S. housing market was grappling with rising interest rates and inflation, which had a profound impact on affordability. The Federal Reserve had implemented a tight monetary policy to combat inflation, resulting in higher borrowing costs for consumers. This made it more difficult for potential homebuyers to obtain mortgages and afford homeownership.

Additionally, the housing market was experiencing a phenomenon known as "redlining." Redlining was a discriminatory practice by lenders, who would deny mortgage loans or charge higher interest rates to individuals based on their race or the neighborhood they lived in. This discriminatory practice disproportionately affected minority communities, leading to further inequalities in access to homeownership and exacerbating housing segregation.

The state of the housing market led to a decline in homeownership rates and a rise in rental demand. Many Americans found it increasingly difficult to qualify for mortgages or afford the high interest rates, resulting in a shift towards renting as a more viable housing option.

In response to the challenges faced by the housing market, the U.S. government implemented several policies and initiatives. One of the notable developments during this period was the passage of the Housing and Community Development Act of 1977. This legislation established the Community Reinvestment Act (CRA), which aimed to combat redlining and promote access to credit in underserved communities.

The CRA required banks to meet the credit needs of the communities in which they operated, including low- and moderate-income neighborhoods. This legislation was a significant step towards addressing housing discrimination and improving access to affordable housing for marginalized communities.

Another important development in the housing market during this time was the introduction of adjustable-rate mortgages (ARMs). ARMs allowed borrowers to obtain mortgages with interest rates that would fluctuate over time, often starting at a lower rate before adjusting to market conditions. This innovation provided some relief for homebuyers, as it offered more flexibility in mortgage payments during a period of high interest rates.

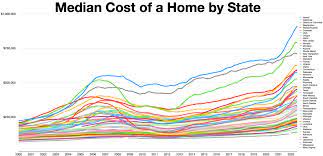

The housing market of September 21, 1978, laid the groundwork for future changes and developments in the industry. The challenges faced during this time prompted a reevaluation of lending practices and a push for greater access to affordable housing.

In the subsequent decades, the U.S. housing market would experience significant fluctuations, including the housing bubble and subsequent financial crisis of 2008. The lessons learned from the challenges of the 1970s would inform future policies and regulations aimed at preventing similar crises and promoting housing stability.

The housing market of September 21, 1978, serves as a reminder of the complex factors that shape the housing landscape. It highlights the importance of government intervention and regulation to ensure fair access to credit and affordable housing for all Americans. The changes and reforms implemented during this period laid the foundation for a more equitable and inclusive housing market in the years to come.