On September 26, 1963, the United States witnessed a significant development in its tax policy with the passage of major tax reforms by the U.S. Congress. These reforms, known as the Revenue Act of 1963, aimed to stimulate economic growth, reduce tax burdens, and address issues of fairness and equity in the tax system.

The Revenue Act of 1963 was signed into law by President John F. Kennedy, who believed that lowering taxes would incentivize economic activity and promote investment. The act included several key provisions that had a lasting impact on the U.S. tax system.

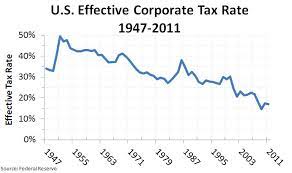

One of the significant changes introduced by the Revenue Act of 1963 was a reduction in corporate tax rates. The top corporate tax rate was lowered from 52% to 48%, with the aim of encouraging businesses to invest, expand, and create jobs. This reduction in corporate taxes was seen as a way to stimulate economic growth and increase competitiveness in the global market.

Another important aspect of the tax reforms was the introduction of accelerated depreciation for businesses. This provision allowed businesses to deduct the cost of their investments more quickly, providing an incentive for companies to invest in new equipment, machinery, and infrastructure. By encouraging capital investment, the reforms aimed to boost productivity and drive economic expansion.

The Revenue Act of 1963 also included measures to address issues of fairness and equity in the tax system. It increased the standard deduction for individual taxpayers and expanded the earned income tax credit, providing relief to low-income families. These provisions were aimed at reducing the tax burden on lower-income individuals and ensuring a more equitable distribution of the tax burden.

Additionally, the act introduced measures to close certain tax loopholes and limit the use of tax shelters. These provisions were designed to prevent high-income individuals and corporations from exploiting tax loopholes to avoid paying their fair share of taxes. By closing these loopholes, the reforms sought to create a more level playing field and promote tax fairness.

The passage of the Revenue Act of 1963 had a significant impact on the U.S. economy. The reduction in corporate tax rates and the introduction of accelerated depreciation stimulated investment and economic growth. The reforms also provided relief to low-income individuals and families, helping to alleviate poverty and promote social welfare.

The tax reforms of 1963 marked a departure from the prevailing tax policy of the time, which had emphasized high tax rates. The reforms reflected a shift towards a more supply-side approach, which focused on stimulating economic activity through lower taxes and incentivizing investment.

The impact of the Revenue Act of 1963 extended beyond the immediate effects on the economy. It set a precedent for subsequent tax reforms and influenced the ongoing debate on tax policy in the United States. The provisions introduced in 1963 laid the groundwork for future tax reforms, including the Tax Reform Act of 1986, which further simplified the tax code and reduced tax rates.

The tax reforms of September 26, 1963, represented a significant milestone in U.S. tax policy. They aimed to stimulate economic growth, address issues of fairness and equity, and promote investment. The provisions introduced in the Revenue Act of 1963 had a lasting impact on the U.S. tax system and set the stage for further reforms in the years to come.