On September 29, 1986, the United States underwent a significant change in its tax system with the signing of the Tax Reform Act of 1986. This landmark legislation represented a comprehensive overhaul of the tax code and had far-reaching implications for individuals, businesses, and the economy as a whole.

The Tax Reform Act of 1986 was a bipartisan effort aimed at simplifying the tax code, reducing tax rates, and closing loopholes. The legislation was signed into law by President Ronald Reagan, who viewed tax reform as a key component of his economic agenda.

One of the primary goals of the Tax Reform Act of 1986 was to simplify the tax system. The previous tax code had become increasingly complex, with numerous deductions, exemptions, and loopholes that favored certain groups or industries. The new legislation sought to streamline the tax code by eliminating many of these special provisions and reducing the number of tax brackets.

Another important aspect of the tax reform was the reduction of tax rates. The top individual tax rate was lowered from 50% to 28%, while the number of tax brackets was reduced from 14 to just two – 15% and 28%. This reduction in tax rates aimed to stimulate economic growth by leaving individuals and businesses with more disposable income to spend, save, or invest.

The Tax Reform Act of 1986 also targeted corporate taxes. It lowered the top corporate tax rate from 46% to 34% and eliminated various tax breaks and shelters that allowed corporations to minimize their tax liability. This change sought to level the playing field and create a more equitable tax system for businesses.

One of the most significant aspects of the tax reform was the elimination of many tax shelters and loopholes. Prior to the reform, wealthy individuals and corporations could take advantage of various deductions and exemptions to reduce their tax burden significantly. The Tax Reform Act closed many of these loopholes, ensuring that everyone paid their fair share of taxes.

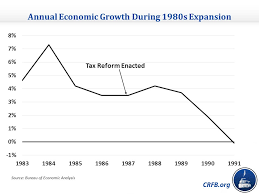

The impact of the Tax Reform Act of 1986 was substantial. The simplification of the tax code made it easier for individuals and businesses to understand and comply with their tax obligations. The reduction in tax rates provided a boost to economic growth, as individuals and businesses had more money to invest and spend. Additionally, the elimination of tax shelters and loopholes increased the fairness and integrity of the tax system.

However, the tax reform was not without its critics. Some argued that the reduction in tax rates disproportionately benefited the wealthy, leading to increased income inequality. Others contended that the elimination of certain deductions and exemptions hurt specific industries or regions of the country.

Despite the criticisms, the Tax Reform Act of 1986 remains one of the most significant tax reforms in U.S. history. Its impact on the economy and the tax system is still felt today, with many of its provisions and principles continuing to shape tax policy discussions.

The events of September 29, 1986, marked a turning point in U.S. tax policy. The Tax Reform Act of 1986 simplified the tax code, lowered tax rates, and closed loopholes, leading to a more equitable and efficient tax system. While debates about tax policy continue, the reform of 1986 remains a testament to the potential for bipartisan cooperation and the ability of lawmakers to enact meaningful change.