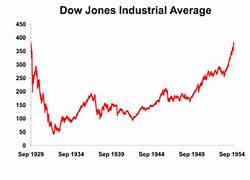

On November 23, 1954, the United States witnessed a significant event in its financial history as the Dow Jones Industrial Average recovered to a remarkable level of 381.17. This event marked a turning point for the U.S. economy and had far-reaching implications for the American people.

To understand the significance of this recovery, it is important to delve into the context of the time. The early 1950s were a period of economic recovery for the United States after the devastating effects of World War II. The country was experiencing a post-war boom, with industries booming, consumer spending on the rise, and an overall sense of optimism in the air.

However, the stock market had been going through a turbulent phase in the preceding months before November 23, 1954. The Dow Jones Industrial Average, which is a composite index of 30 major U.S. companies, had experienced a decline in the months leading up to this date. This decline was primarily driven by concerns over rising interest rates, inflation, and geopolitical uncertainties, which had created an atmosphere of caution among investors.

On November 23, 1954, the Dow Jones Industrial Average made a remarkable recovery, reaching a level of 381.17. This recovery was seen as a sign of stability and resilience in the U.S. economy, instilling confidence in investors and the general public alike. It signaled that the concerns that had plagued the market were being addressed and that the economy was on a path to recovery.

This recovery had several implications for the American people. Firstly, it restored faith in the stock market as a viable investment avenue. Many individuals and institutions had been hesitant to invest in stocks during the previous months, fearing further declines. The recovery on November 23, 1954, reassured investors that the stock market was not a lost cause, leading to increased participation and investment.

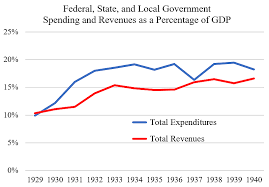

Secondly, the recovery had a positive impact on the overall economy. A strong stock market often translates into increased consumer spending and business investments. The recovery of the Dow Jones Industrial Average injected optimism into the market, leading to increased economic activity and job creation. This, in turn, contributed to the overall growth and prosperity of the nation.

Furthermore, the recovery of the Dow Jones Industrial Average also had a psychological impact on the American people. It served as a symbol of national resilience and strength, reminding citizens of the country's ability to overcome challenges. It instilled a sense of confidence and pride in the nation's economic prowess, reinforcing the belief in the American dream and the potential for success.