On September 12, 1997, the United States was experiencing a significant increase in bankruptcy filings, reflecting a growing financial crisis affecting individuals and businesses across the country. This date serves as a reminder of the economic challenges faced by many during that time and the long-lasting effects on the American economy.

The late 1990s saw a combination of factors contributing to the rise in bankruptcy filings. One of the main factors was the bursting of the dot-com bubble, which had led to the collapse of many internet-based companies. The stock market experienced significant losses, and investors saw their portfolios decimated, leading to financial instability for many.

Additionally, the 1997 Asian financial crisis had a ripple effect on the global economy, impacting American businesses and industries. The crisis, which originated in Thailand and spread to other Asian countries, caused a sharp drop in demand for American goods and affected export-oriented industries.

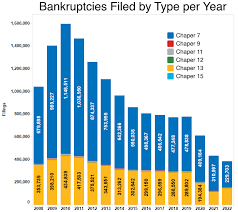

Furthermore, the 1990s saw a significant increase in consumer debt. Easy access to credit cards and the availability of subprime lending led many individuals to accumulate high levels of debt. As interest rates increased, many borrowers found themselves unable to keep up with payments, leading to a surge in personal bankruptcy filings.

The rise in bankruptcy filings had far-reaching consequences. It affected not only individuals but also businesses of all sizes. Small businesses, in particular, struggled to stay afloat, leading to job losses and economic instability in many communities.

The impact of the increasing bankruptcy filings was felt across various sectors of the economy. Financial institutions faced significant losses as borrowers defaulted on loans, and many had to write off substantial amounts of debt. This, in turn, led to a tightening of credit and stricter lending practices, making it even more difficult for individuals and businesses to obtain financing.

The federal government recognized the seriousness of the situation and took steps to address the crisis. In 1998, Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act, which aimed to reform bankruptcy laws and make it more difficult for individuals to file for bankruptcy. The legislation introduced stricter eligibility criteria and increased the requirements for debt repayment.

The effects of the financial crisis of the late 1990s continued to be felt for years to come. It served as a wake-up call for individuals, businesses, and policymakers about the importance of responsible financial practices and the need for regulatory oversight. The crisis also highlighted the interconnectedness of the global economy and the potential for financial turmoil to spread across borders.

While the increase in bankruptcy filings on September 12, 1997, was a challenging and difficult time for many, it also spurred a reevaluation of financial practices and prompted individuals and businesses to adopt more prudent strategies. Lessons learned from this period have shaped financial regulations and practices to mitigate the risk of similar crises in the future.

Today, the memory of the financial crisis of the late 1990s serves as a reminder of the importance of prudent financial management, responsible lending practices, and the need for a robust regulatory framework to safeguard the economy. It stands as a testament to the resilience and adaptability of the American economy, which has weathered numerous challenges throughout its history.