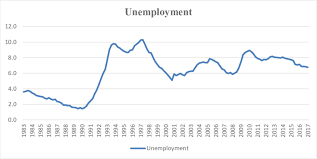

On October 9, 1983, the United States faced a critical economic challenge as it grappled with high levels of unemployment. The unemployment rate, a key indicator of the health of the labor market, was a major concern for policymakers and the American public during this time.

In 1983, the U.S. was recovering from a severe recession that had begun in 1981. The recession, characterized by high inflation and high interest rates, had led to significant job losses and a sharp increase in unemployment. As a result, the unemployment rate reached a peak of 10.8% in November 1982, the highest level since the Great Depression.

By October 9, 1983, the unemployment rate had declined slightly, but it still remained elevated at 8.5%. This meant that millions of Americans were out of work and struggling to find employment. The high unemployment rate had far-reaching consequences, impacting individuals, families, and the overall economy.

The persistently high unemployment rate placed a heavy burden on those who were unemployed. It created financial hardships, increased stress levels, and eroded confidence in the job market. Many individuals and families faced difficulties in meeting their basic needs, such as housing, food, and healthcare.

The high unemployment rate also had broader implications for the economy. It signaled a lack of demand for goods and services, as businesses were hesitant to hire new employees in an uncertain economic environment. This lack of demand further contributed to the sluggish recovery from the recession and hindered economic growth.

Addressing the high unemployment rate became a top priority for policymakers. The Federal Reserve, under the leadership of Chairman Paul Volcker, pursued an aggressive monetary policy to combat inflation and stimulate economic activity. The Fed lowered interest rates, which encouraged borrowing and investment, and ultimately helped spur economic growth and job creation.

Additionally, the government implemented various fiscal policies to stimulate the economy and promote job creation. The Economic Recovery Tax Act of 1981, for example, aimed to incentivize business investment and stimulate economic activity. These measures, along with increased government spending on infrastructure projects, helped create jobs and reduce the unemployment rate over time.

Gradually, the U.S. economy began to recover from the recession, and the unemployment rate started to decline. By the end of 1983, the rate had fallen to 8.0%, signaling some progress in the labor market. The decline in unemployment was a positive development, as it provided hope for individuals and families, and contributed to a sense of optimism about the future.

The high unemployment rate of 1983 serves as a reminder of the challenges and hardships faced during times of economic downturn. It highlights the importance of implementing effective policies and strategies to stimulate job creation and foster economic growth. The experience of the 1980s recession and the subsequent recovery helped shape future economic policies and provided valuable lessons for addressing economic crises.

Today, the unemployment rate remains a critical economic indicator, closely monitored by policymakers, economists, and the public. It serves as a barometer of the labor market's health and provides insights into the overall state of the economy. The lessons learned from past experiences, such as the challenges faced in 1983, continue to inform efforts to address unemployment and promote sustainable economic growth.