In 1923, the United States of America experienced significant tax decreases that had a profound impact on the nation's economy and the lives of its citizens. This period marked a shift in government policy towards reducing the burden of taxes on individuals and businesses, fostering economic growth and prosperity.

During the early 1920s, the U.S. economy was recovering from the aftermath of World War I. The government recognized the need for measures to stimulate economic activity and encourage investment. In response, the Revenue Act of 1921 was passed, which initiated a series of tax cuts aimed at spurring economic growth.

One of the key provisions of the Revenue Act of 1921 was the reduction of income tax rates. The highest marginal tax rate, which had reached 73% during the war, was lowered to 58% for individuals and 46% for corporations. This significant decrease in tax rates allowed individuals and businesses to keep more of their earnings, providing them with the means to invest, expand, and create jobs.

The tax cuts of 1923 went even further in reducing the burden on taxpayers. Under the leadership of President Calvin Coolidge, the Revenue Act of 1923 was enacted, further lowering income tax rates for individuals and corporations. The highest marginal tax rate was reduced to 46% for individuals and 43.5% for corporations. These tax decreases aimed to incentivize economic activity and promote investment and innovation.

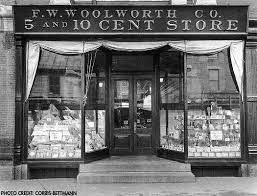

The tax cuts of 1923 had a positive impact on the U.S. economy. They stimulated business growth and investment, leading to increased productivity and job creation. With lower tax rates, individuals and corporations had more disposable income, which they could spend or invest as they saw fit. This injection of capital into the economy helped fuel economic expansion and contributed to the prosperity of the Roaring Twenties.

Lower taxes also encouraged entrepreneurial activity and innovation. With a reduced tax burden, individuals and businesses had more resources available to take risks and pursue new ventures. This environment of economic freedom and opportunity fostered the growth of industries such as manufacturing, automobiles, and consumer goods, which became synonymous with the era.

The tax decreases of 1923 also had a positive effect on individual taxpayers. With lower income tax rates, workers had more money in their pockets, allowing them to improve their standard of living and enjoy the benefits of increased purchasing power. The tax cuts provided relief for middle-class families and helped stimulate consumer spending, which further bolstered economic growth.

However, it is worth noting that the tax decreases of the 1920s were not without controversy. Some critics argued that the tax cuts disproportionately benefited the wealthy, leading to increased income inequality. Others expressed concerns about the long-term fiscal implications of reduced tax revenue and the potential impact on government programs and services.