In 2007, Saudi Arabia played a pivotal role in the global oil market, with significant implications for the United States and the world economy. At the center of this economic interplay was the pricing of oil in U.S. dollars, a longstanding practice that had profound consequences for both nations.

Saudi Arabia, as the world's leading oil exporter, held a unique position in determining global oil prices. The country's currency, the Saudi riyal, was pegged to the U.S. dollar, meaning that fluctuations in the dollar's value directly influenced Saudi Arabia's economic policies. This pegging had been in place for decades, fostering a stable economic relationship between the two nations.

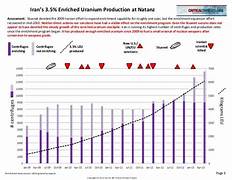

During 2007, the price of oil reached historic highs, surpassing $90 per barrel in October. This surge was driven by a combination of geopolitical tensions, increased global demand, and supply concerns. Saudi Arabia, as a major player in the Organization of the Petroleum Exporting Countries (OPEC), had the ability to influence oil prices through its production decisions.

The pricing of oil in U.S. dollars had its roots in the 1970s, when a series of agreements known as the Petrodollar System were established. In essence, OPEC members, including Saudi Arabia, agreed to sell their oil exclusively in U.S. dollars. This arrangement had profound implications for global trade and finance. Countries around the world needed U.S. dollars to purchase oil, creating a constant demand for the currency and solidifying its status as the world's primary reserve currency.

The year 2007 marked a period of increased scrutiny and debate over the Petrodollar System. Some critics argued that the system disproportionately benefited the United States, allowing it to run persistent trade deficits and accumulate large amounts of debt. The dependence on the U.S. dollar for oil transactions also exposed other nations to the volatility of the dollar, which could have far-reaching economic consequences.

As oil prices surged, the strain on the global economy became apparent. The United States, being a major oil consumer, faced challenges as rising energy costs impacted various sectors. The housing market, already showing signs of vulnerability, experienced further stress as consumers grappled with higher fuel prices. Additionally, industries reliant on transportation and energy-intensive processes confronted increased operational costs.

Saudi Arabia, while reaping the benefits of record-high oil prices, also faced dilemmas. The country had to carefully balance its desire for economic stability with the need to address global concerns about the impact of high oil prices on inflation and economic growth. The peg to the U.S. dollar, which had served Saudi Arabia well in maintaining economic stability, became a subject of debate as some called for a reevaluation of the currency regime.