The year 2009 marked a pivotal moment in the economic history of the United States as the nation grappled with the aftermath of the global financial crisis. One of the alarming developments during this time was the announcement that the federal deficit would exceed $1 trillion in the coming year. This revelation underscored the severity of the economic challenges facing the country and prompted widespread concern about the fiscal health of the nation.

The roots of the 2009 deficit crisis can be traced back to the financial turmoil that unfolded in 2008. The collapse of major financial institutions, the housing market crisis, and a cascading series of events led to a severe economic recession, characterized by job losses, plummeting consumer confidence, and a contraction in economic activity. In response to the crisis, the government embarked on unprecedented interventions to stabilize the economy and prevent a complete financial collapse.

The Troubled Asset Relief Program (TARP), initiated in 2008, was a major component of the government's response to the financial crisis. TARP aimed to stabilize the financial system by providing funds to troubled banks and financial institutions. Additionally, the government implemented stimulus measures to boost economic activity, including the American Recovery and Reinvestment Act (ARRA) signed into law by President Barack Obama in early 2009.

While these measures were deemed necessary to prevent a deeper economic downturn, they came at a considerable cost. The federal government incurred substantial expenses in the form of bailouts, stimulus packages, and increased social safety net spending to address the growing unemployment and economic distress. As a result, the budget deficit, which represents the gap between government spending and revenue, ballooned to unprecedented levels.

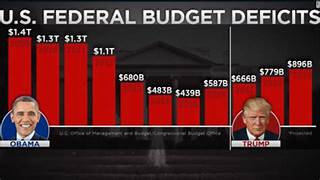

In early 2009, the Congressional Budget Office (CBO) released projections indicating that the federal deficit for the fiscal year 2010 would exceed $1 trillion. This announcement sent shockwaves through the political and economic spheres, as it represented a historic and alarming level of fiscal imbalance. The deficit-to-GDP ratio reached levels not seen since World War II, raising concerns about the long-term consequences for the nation's fiscal health.

The factors contributing to the soaring deficit were multifaceted. Reduced tax revenues due to the economic downturn played a significant role, as did the increased government spending aimed at stabilizing the economy. The combination of automatic stabilizers, such as unemployment benefits, and discretionary spending on stimulus programs contributed to the unprecedented fiscal gap.

The announcement of a deficit surpassing $1 trillion underscored the urgency of addressing the economic challenges facing the nation. It also fueled debates about the appropriate role of government in times of crisis and the long-term consequences of accumulating significant levels of national debt. Critics argued that the growing deficit posed risks to the country's economic stability and future generations, while proponents contended that the immediate need to stimulate the economy justified the necessary expenditures.

Ultimately, the 2009 deficit crisis became a focal point in discussions about economic policy, government intervention, and fiscal responsibility. The events of that year set the stage for ongoing debates about the role of government in managing economic crises and the delicate balance between stimulating economic recovery and maintaining fiscal discipline. The repercussions of the deficit exceeding $1 trillion in 2009 reverberated through subsequent policy decisions and shaped the economic landscape of the following years.