On August 30, 1935, the United States saw the implementation of the Wealth Tax Act, a significant piece of legislation aimed at addressing the economic challenges of the Great Depression. The Wealth Tax Act, also known as the Revenue Act of 1935, marked a turning point in the country's tax policy and played a crucial role in the redistribution of wealth during a time of economic crisis.

The Great Depression of the 1930s brought about widespread unemployment, poverty, and economic hardship. As the country struggled to recover from the devastating effects of the stock market crash in 1929, President Franklin D. Roosevelt and his administration sought to implement policies that would stimulate economic growth and provide relief to those most affected by the crisis.

The Wealth Tax Act was part of a broader set of reforms known as the Second New Deal. It aimed to address the growing wealth inequality in the country and generate revenue to fund social programs and infrastructure projects. The act introduced progressive tax rates for individuals and corporations, with higher income brackets facing higher tax rates.

One of the key provisions of the Wealth Tax Act was the introduction of the first federal estate tax. This tax placed a levy on the transfer of property and assets upon a person's death. It aimed to prevent the concentration of wealth in the hands of a few and promote a more equitable distribution of resources.

The act also increased the tax rate on corporate profits, seeking to generate revenue from businesses that had benefited from the economic growth of the 1920s. Additionally, it introduced higher individual income tax rates for higher income brackets, ensuring that those with greater wealth paid a larger share of their income in taxes.

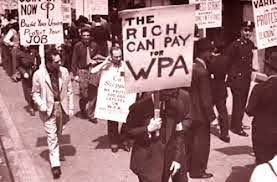

The implementation of the Wealth Tax Act faced opposition from some segments of society, particularly the wealthy and business interests. Critics argued that the act would stifle economic growth and discourage investment. However, proponents emphasized the need to address the economic disparities that had contributed to the Great Depression and argued that the act would provide much-needed revenue for social programs and public works projects.

The Wealth Tax Act had a significant impact on the redistribution of wealth and the funding of social programs. The revenue generated from the act allowed the government to invest in infrastructure projects, such as the construction of roads, bridges, and public buildings. It also provided funding for social welfare programs, including unemployment benefits, old-age pensions, and the creation of the Social Security system.

The act played a crucial role in shaping the country's tax policy for years to come. It established the foundation for a progressive tax system that remains a central aspect of the U.S. tax code. The principles of wealth redistribution and the importance of progressive taxation advocated by the Wealth Tax Act continue to be debated and shape discussions around economic policy and income inequality.

The implementation of the Wealth Tax Act on August 30, 1935, marked a significant moment in U.S. history. It represented a shift towards a more progressive tax system and played a crucial role in addressing the economic challenges of the Great Depression. The act's provisions aimed at redistributing wealth and providing funding for social programs continue to shape the country's tax policy and serve as a reminder of the importance of economic equity and the role of government in promoting social welfare.