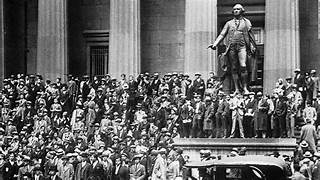

On October 24, 1929, the United States experienced one of the darkest days in its economic history - the Wall Street Crash, also known as Black Thursday. This event marked the beginning of the Great Depression, a severe worldwide economic downturn that had lasting effects on the global economy.

Leading up to Black Thursday, the stock market had been experiencing a period of rapid growth and speculation. Investors were buying shares of stock on margin, meaning they were borrowing money to invest in the market, with the expectation of making significant profits. However, this speculative bubble would burst on October 24, 1929.

The crash began with a significant decline in stock prices, as nervous investors started selling their shares in large volumes. As panic spread, more and more investors rushed to sell, causing a massive sell-off that sent shockwaves through the financial markets. The stock market plummeted, wiping out billions of dollars in wealth within a matter of hours.

The effects of the crash were devastating. Investors and businesses faced massive losses, leading to a wave of bankruptcies and closures. Unemployment skyrocketed as companies downsized or shut down completely. Consumer spending also plummeted, as people struggled to make ends meet. The crash had a ripple effect throughout the economy, causing a severe contraction in economic activity.

The Wall Street Crash exposed the flaws in the financial system and highlighted the dangers of excessive speculation. It revealed the fragility of the stock market and the interconnectedness of the global economy. The crash served as a wake-up call for regulators and policymakers, who would go on to implement significant reforms to prevent a similar catastrophe in the future.

In response to the crash, the U.S. government took several measures to stabilize the economy. The Federal Reserve, the nation's central bank, injected liquidity into the financial system to prevent a complete collapse. The government also implemented regulations to curb speculation and increase transparency in the stock market.

However, these efforts were not enough to prevent the deepening of the economic crisis. The Great Depression would continue to worsen throughout the 1930s, with unemployment reaching staggering levels and poverty becoming widespread. It would take years of government intervention and economic policies, such as President Franklin D. Roosevelt's New Deal, to begin the slow process of recovery.

The Wall Street Crash of 1929 remains a significant event in American history, serving as a stark reminder of the dangers of unchecked speculation and the fragility of the global financial system. It caused widespread economic hardship and reshaped the trajectory of the nation and the world. The lessons learned from the crash continue to inform economic policies and financial regulations to this day.